BRISPOT Konsumer

-

4.2

- 401 Votes

- 2.0.15 Version

- 29.60M Size

About

Recommend

Discover

Introduction

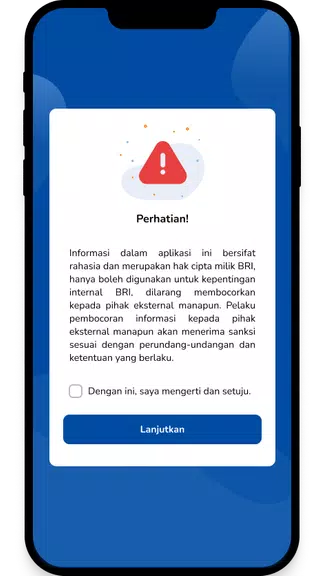

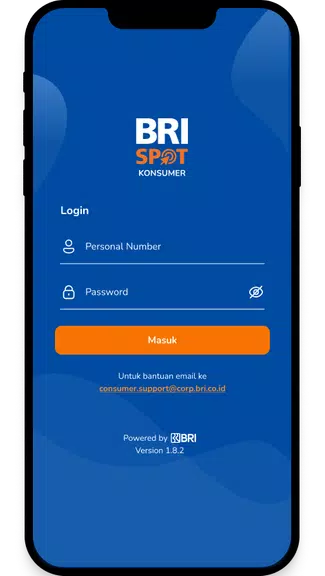

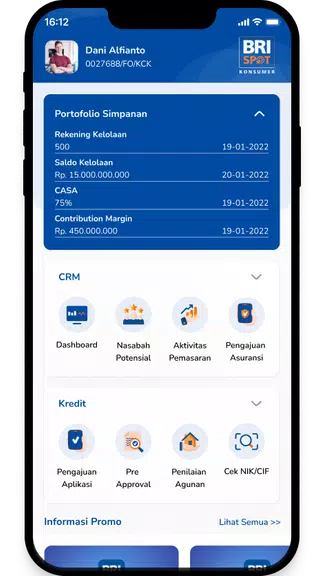

The BRISPOT Konsumer App is revolutionizing the way BRI employees handle credit and loan services. With a range of powerful features, this internal application streamlines the entire process, from credit initiatives to tracking and customer relationship management. Need a mortgage or a credit card? Look no further. BRISPOT Konsumer has got you covered. Want to make quick and informed credit decisions? This app provides the tools and information you need to do just that. Plus, with loan simulation and referrals at your fingertips, you'll be able to offer the best possible service to your customers. Say goodbye to outdated systems and hello to efficiency with the app.

Features of BRISPOT Konsumer:

* Convenient Credit Initiatives: The app offers various credit initiatives such as KPR (home loan), BRIGUNA (multifunction loan), and credit card applications. This makes it easy for BRI employees to access funding for their personal and professional needs without any hassle.

* Credit Decision Assistance: With the credit decision feature, BRI employees can have their loan applications processed quickly and efficiently. The app provides real-time updates on the status of the application and helps employees understand the reasons behind the decision, ensuring transparency and avoiding any confusion.

* Seamless Loan Simulation: BRISPOT Konsumer allows employees to simulate their loan scenarios, helping them determine the most suitable loan option for their financial situation. By inputting different parameters like loan amount, interest rate, and loan term, employees can get an accurate estimation of monthly payments and decide accordingly.

* Efficient Tracking Mechanism: The tracking feature allows BRI employees to monitor the progress of their credit applications in real-time. It provides updates on each stage of the approval process, from document submission to loan disbursal. This helps employees stay informed and reduces the time spent on follow-ups with the bank.

Tips for Users:

* Plan Ahead: Before using the app, it is advisable for BRI employees to gather all the necessary documents and information related to their loan application. This will provide a smooth and seamless experience while using the app.

* Utilize Loan Simulation: Take advantage of the loan simulation feature to compare different loan options and understand the financial impact of each choice. This will help employees make an informed decision and choose the best loan plan suited for their needs.

* Monitor Progress Regularly: Keep an eye on the progress of the loan application through the tracking feature. Regularly checking for updates will allow users to address any issues promptly and ensure a smooth approval process.

Conclusion:

BRISPOT Konsumer is a comprehensive internal application designed specifically for BRI employees, offering attractive features that simplify the credit application process. With convenient credit initiatives, efficient credit decision support, seamless loan simulation, and a tracking mechanism, employees can easily manage their credit needs and monitor the progress in real-time. By following the playing tips, users can maximize the benefit of the app and make well-informed financial decisions. The app is a must-have tool for BRI employees, providing convenience, transparency, and efficiency in their credit journey.

Similar Apps

You May Also Like

Latest Apps

-

Download

Download마이달링

Communication / 42.70MB

-

Download

DownloadAarong

Shopping / 9.10MB

-

Download

DownloadMarliangComic

News & Magazines / 3.40MB

-

Download

DownloadHide Pictures & Videos - FotoX

Tools / 34.49MB

-

Download

DownloadSlovakia Dating

Communication / 12.90MB

-

Download

DownloadAman Car

Travel / 8.18MB

-

Download

DownloadDOTDOT

Personalization / 11.00MB

-

Download

DownloadAuctionTime

Finance / 15.60MB

-

Download

DownloadShareMe

Others / 35.20MB

-

Download

DownloadMstyle

Lifestyle / 30.30MB

Comments