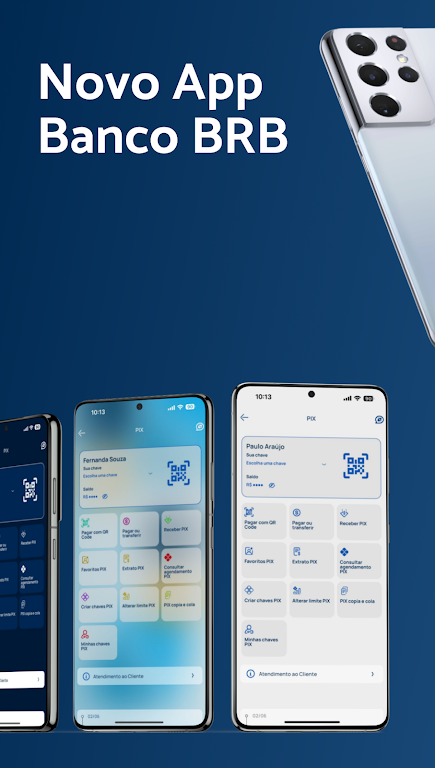

BRB Mobile

-

4.1

- 476 Votes

- 7.9.1 Version

- 230.30M Size

About

Recommend

Discover

Introduction

Discover the BRB Mobile app, your all-in-one solution for digital financial needs. With this innovative app, you can open a free digital account in just hours, avoiding tedious paperwork and hidden fees. Apply for a credit card and enjoy exclusive benefits that enhance your financial experience. Need a loan? Banco BRB provides competitive rates for quick access to funds. The user-friendly interface simplifies payments via PIX, and you can protect your home with convenient insurance options. Plus, explore savings bonds, visualize real estate financing, and invest safely with various options. Download the app on Google Play today for effortless financial management!

Features of BRB Mobile:

- Complete Digital Financial Experience

The app offers users a complete digital financial experience, allowing them to access a range of benefits and services conveniently from their mobile devices. With this app, users can easily open a digital checking account without bureaucracy or the need to leave their home. They can also apply for credit cards with exclusive benefits, secure loans at the best market rates, and make payments quickly and easily through the PIX feature.

- Home Insurance and Savings Bonds

One of the standout features of the app is the ability to protect your home with home insurance. Users can easily access home insurance options within the app, ensuring that their most valuable asset is safeguarded against unforeseen events. Additionally, the app offers savings bonds, giving users the chance to save money while competing for incredible prizes. This unique feature sets the app apart from other financial apps on the market.

- Real Estate Financing and Investment Opportunities

For those looking to fulfill their dream of owning a home, the app makes it easy to visualize and simulate real estate financing. With just a few taps on their smartphone, users can explore different financing options and make informed decisions about their home purchase. Moreover, the app offers opportunities for safe investment, including fixed and variable income options such as CDB, LCI, investment funds, and the BRB Investimentos platform. This gives users the chance to grow their wealth and achieve their financial goals.

- Free Digital Account with No Fees

Unlike many traditional banks, Banco BRB offers users a free digital account with no fees. This means that users can enjoy the convenience and benefits of a digital banking experience without incurring any additional costs. By opening a digital account through the app, users can easily manage their finances, make transactions, and access a range of financial services without worrying about hidden fees or charges.

Tips for Users:

- Explore Exclusive Credit Card Benefits

After applying for a credit card through the app, be sure to take full advantage of the exclusive benefits offered. This may include cashback rewards, discounts on partner merchant purchases, or access to special events. By exploring and utilizing these benefits, you can make the most of your credit card and maximize your savings.

- Leverage Investment Opportunities

If you're interested in growing your wealth and investing in the app, take the time to explore the different investment options available. From fixed income investments to variable income options, there are various opportunities to suit different risk appetites and financial goals. Research and consider the investment options carefully to make informed decisions and potentially earn attractive returns on your investments.

- Stay Up to Date with App Notifications

To ensure you never miss out on important account updates, exclusive offers, or upcoming prize competitions, enable push notifications on the app. By doing so, you'll receive timely reminders and alerts straight to your device, keeping you informed and connected to your personal finances. Regularly check your notifications and take advantage of any time-sensitive offers or promotions.

Conclusion:

With its comprehensive range of features and services, BRB Mobile offers users a convenient and rewarding digital financial experience. From opening a digital account with no fees to accessing exclusive credit card benefits and investment opportunities, this app has it all. Moreover, its inclusion of home insurance options and savings bonds sets it apart from other banking apps. By utilizing the tips provided, users can make the most of the app's offerings and enjoy a seamless and rewarding finance journey.

Similar Apps

You May Also Like

Latest Apps

-

Download

Download마이달링

Communication / 42.70MB

-

Download

DownloadAarong

Shopping / 9.10MB

-

Download

DownloadMarliangComic

News & Magazines / 3.40MB

-

Download

DownloadHide Pictures & Videos - FotoX

Tools / 34.49MB

-

Download

DownloadSlovakia Dating

Communication / 12.90MB

-

Download

DownloadAman Car

Travel / 8.18MB

-

Download

DownloadDOTDOT

Personalization / 11.00MB

-

Download

DownloadAuctionTime

Finance / 15.60MB

-

Download

DownloadShareMe

Others / 35.20MB

-

Download

DownloadMstyle

Lifestyle / 30.30MB

Comments