Mini - Canal Circle

-

4.1

- 254 Votes

- 2021.5.1 Version

- 23.20M Size

About

Recommend

Discover

Introduction

Introducing Mini - Canal Circle, the ultimate app designed specifically for microfinance units to effortlessly manage customer information. With the app, credit officers can seamlessly handle hundreds of customers all in one place, catering to the unique requirements of the microcredit industry. From adding customers and creating new loan profiles to inputting borrowers' data and providing loan information and suggestions, the app has got it all covered. What's more, this app even assists in analyzing borrowers' information, managing loan records with utmost convenience, and offers support for printing essential loan documents. Say goodbye to tedious paperwork and say hello to the app - your new microfinance management companion.

Features of Mini - Canal Circle:

* Efficient Customer Management: The app is a game-changing application that streamlines the process of managing customer information for microfinance units. It helps credit officers handle hundreds of customers simultaneously, enabling them to prioritize and focus on providing excellent service.

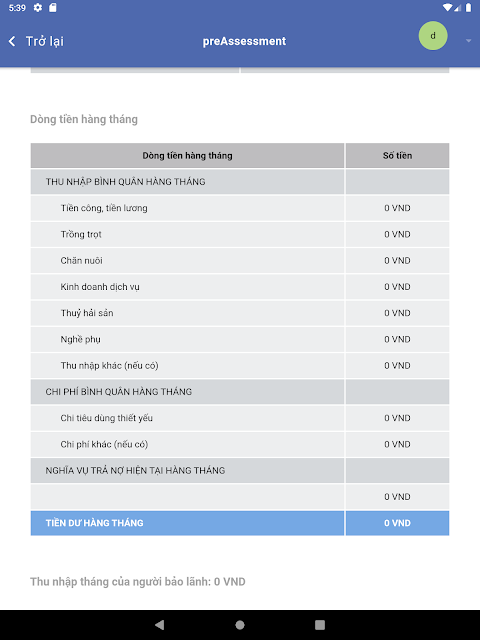

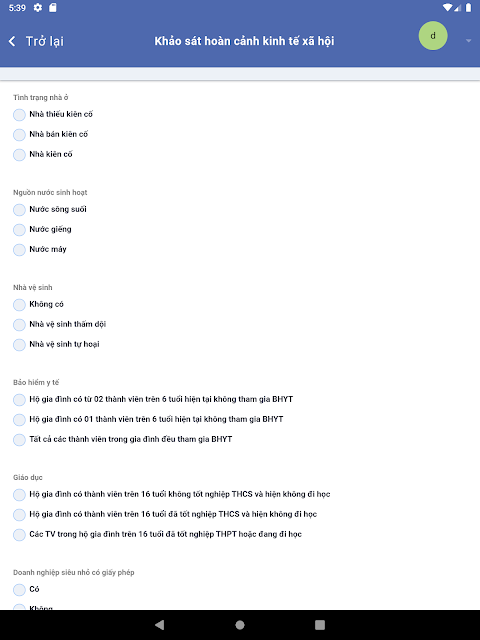

* Simplified Loan Profile Creation: With the app, creating new loan profiles becomes hassle-free. The app provides an intuitive interface, allowing credit officers to input relevant borrower information quickly and accurately. This feature saves time and ensures that all essential data is recorded for future reference.

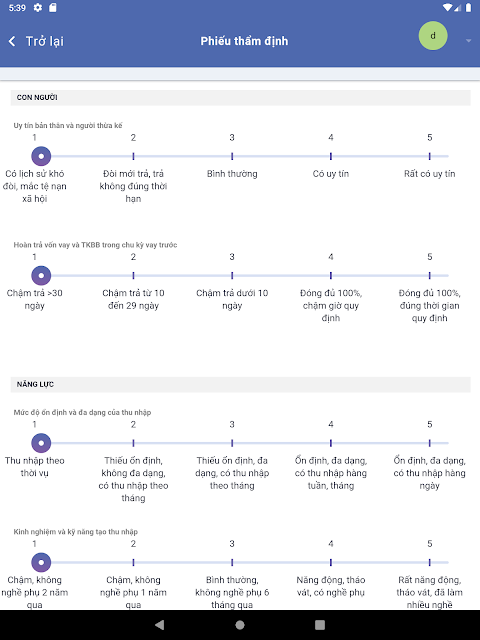

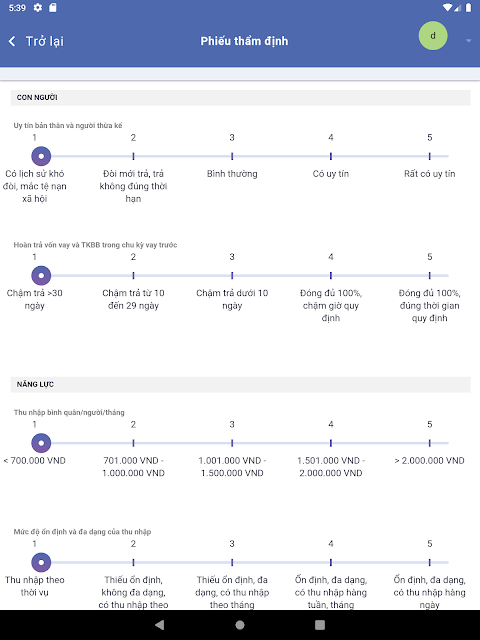

* Smart Loan Recommendations: The app goes beyond just managing customer information. It also offers intelligent loan recommendations based on borrowers' data. By analyzing and understanding borrowers' financial situations, the app suggests suitable loan options, assisting credit officers in making informed decisions that meet the needs of their customers.

* Convenient Loan Record Management: Gone are the days of cumbersome paperwork. The app simplifies the loan record management process. Through the app, credit officers can easily access, update, and organize loan records with a few taps on their smartphones or tablets. This convenient feature not only saves time but also enhances overall productivity.

Tips for Users:

* Take Advantage of Customer Categorization: Organize your customers into different categories based on their needs, repayment history, or loan types. This categorization will help you efficiently manage your clients and provide personalized services.

* Regularly Update Borrower Information: Stay up to date with your borrowers' information by regularly updating their profiles. This will give you a comprehensive view of their financial situations, allowing you to tailor loan recommendations that suit their changing needs.

* Utilize Loan Analysis Tools: Make the most of the app's loan analysis tools. These tools provide valuable insights into borrowers' data, helping you identify patterns, trends, and potential risks. Leveraging this information will empower you to make data-driven decisions and minimize lending risks.

Conclusion:

Mini - Canal Circle is a game-changer in the microfinance industry, offering a comprehensive solution for managing customer information and loan profiles. With its efficient customer management capabilities, simplified loan profile creation, smart loan recommendations, and convenient loan record management, the app empowers credit officers to provide exceptional service to their customers while saving time and enhancing productivity. By utilizing the app's features effectively, credit officers can optimize their operations, make informed lending decisions, and ultimately drive the success of their microfinance units. Download the app now and experience the future of microfinance management.

Similar Apps

You May Also Like

Latest Apps

-

Download

Download마이달링

Communication / 42.70MB

-

Download

DownloadAarong

Shopping / 9.10MB

-

Download

DownloadMarliangComic

News & Magazines / 3.40MB

-

Download

DownloadHide Pictures & Videos - FotoX

Tools / 34.49MB

-

Download

DownloadSlovakia Dating

Communication / 12.90MB

-

Download

DownloadAman Car

Travel / 8.18MB

-

Download

DownloadDOTDOT

Personalization / 11.00MB

-

Download

DownloadAuctionTime

Finance / 15.60MB

-

Download

DownloadShareMe

Others / 35.20MB

-

Download

DownloadMstyle

Lifestyle / 30.30MB

Comments