Interest(ing) Calculator

-

4

- 221 Votes

- 1.1 Version

- 1.20M Size

About

Recommend

Discover

Introduction

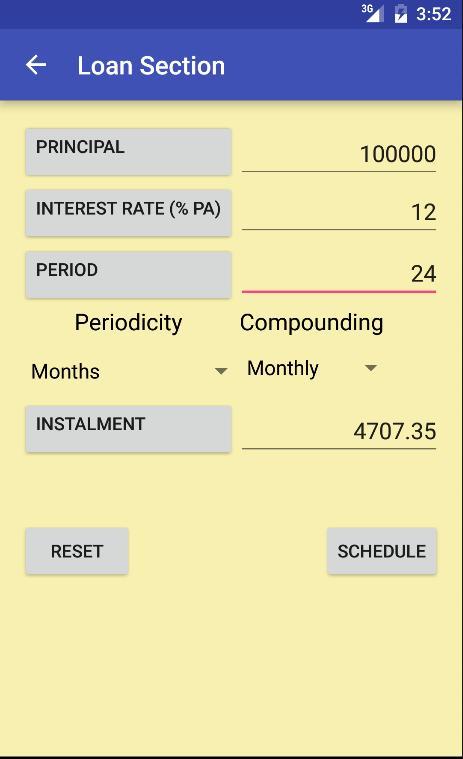

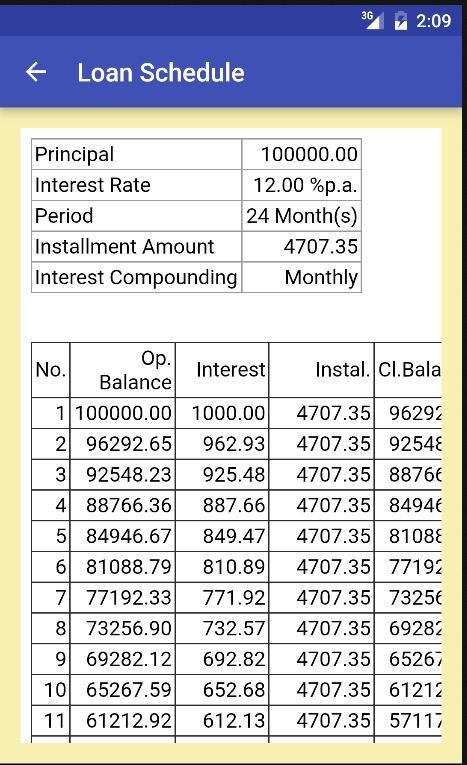

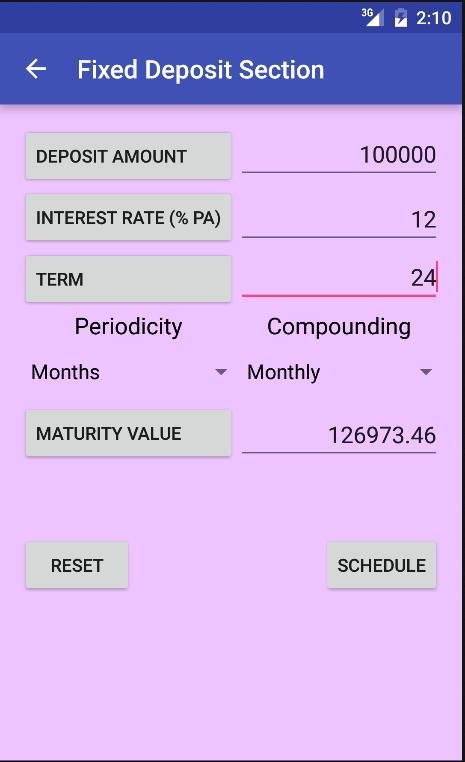

With Interest(ing) Calculator, financial calculations are made easy and efficient. Whether you're dealing with loans, fixed deposits, or recurring deposits, this app has got you covered. It's as simple as inputting three of the four parameters (principal, interest rate, period, installments), and the app will calculate the missing one for you. Plus, you have the flexibility to choose different compounding periods and installment periods. So, if you want to repay your loan in quarterly installments while having your interest compounded monthly, this app can handle it. Say goodbye to complex financial calculations and hello to simplicity with Interest(ing) Calculator.

Features of Interest(ing) Calculator:

Versatile Calculation: The Interest(ing) Calculator is a powerful tool that allows users to calculate any parameter in interest calculations as long as they know the other three parameters. This flexibility makes it a useful tool for a wide range of financial situations, whether it's calculating loan repayments, fixed deposit returns, or recurring deposit growth.

Customizable Compounding Periods: Users can select different compounding periods for interest and installment payments. For example, if someone has a loan with quarterly installments, they can choose to compound the interest on a monthly basis. This level of customization allows users to tailor the calculations to their specific needs and preferences.

Easy-to-Use Interface: The app's user-friendly interface makes it simple for anyone to input the necessary data and retrieve accurate calculations. Even individuals with limited financial knowledge can navigate the app with ease, thanks to its intuitive design and clear instructions.

Time-Saving Solution: Performing complex interest calculations manually can be time-consuming and prone to errors. However, with the Interest(ing) Calculator, users can quickly obtain accurate results without the need for manual calculations. This time-saving feature is particularly beneficial for busy professionals or individuals who deal with frequent financial transactions.

Tips for Users:

Familiarize Yourself with the Parameters: Before using the Interest(ing) Calculator, make sure you understand the different parameters involved in interest calculations. These parameters include principal, interest rate, period, and installments. With a clear understanding of these variables, you can make more informed decisions when inputting data into the app.

Experiment with Different Scenarios: The app's flexibility allows you to experiment with various scenarios by inputting different values for the parameters. This feature is particularly useful for individuals who want to compare the impact of different interest rates, payment periods, or principal amounts. By exploring different scenarios, you can gain a better understanding of how these factors affect the final calculations.

Take Advantage of Customization Options: Utilize the ability to select different compounding periods and installment periods to customize the calculations to your specific needs. This allows you to align the calculations with the actual terms of your financial transactions, ensuring accurate results that reflect your unique situation.

Conclusion:

Its versatile functionality, customizable options, and user-friendly interface make it an attractive tool for both financial professionals and individuals seeking a convenient solution for their financial planning needs. By harnessing the power of this app, users can save time, avoid manual errors, and gain a better understanding of the impact of different interest scenarios. Download the Interest(ing) Calculator now and take control of your financial calculations with ease.

Similar Apps

Latest Apps

-

Download

Download마이달링

Communication / 42.70MB

-

Download

DownloadAarong

Shopping / 9.10MB

-

Download

DownloadMarliangComic

News & Magazines / 3.40MB

-

Download

DownloadHide Pictures & Videos - FotoX

Tools / 34.49MB

-

Download

DownloadSlovakia Dating

Communication / 12.90MB

-

Download

DownloadAman Car

Travel / 8.18MB

-

Download

DownloadDOTDOT

Personalization / 11.00MB

-

Download

DownloadAuctionTime

Finance / 15.60MB

-

Download

DownloadShareMe

Others / 35.20MB

-

Download

DownloadMstyle

Lifestyle / 30.30MB

Comments