FlexPay: Personal Loan App

-

4.4

- 145 Votes

- 4.9 Version

- 34.50M Size

About

Recommend

Discover

Introduction

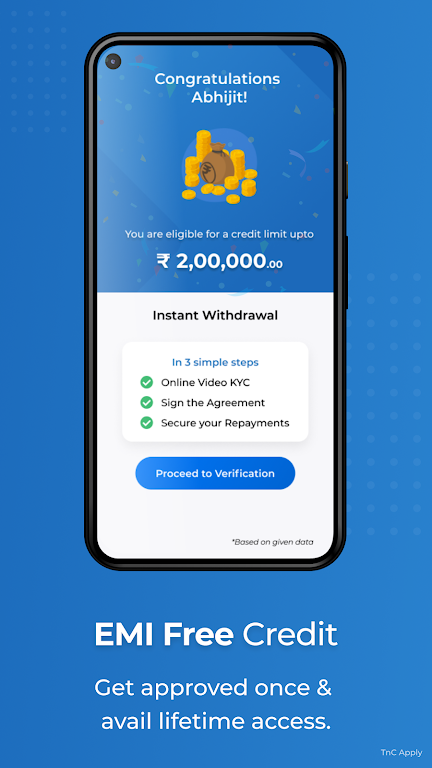

FlexPay: Personal Loan App is a convenient and user-friendly personal loan app that aims to simplify your life by providing instant access to credit. Whether you need to buy groceries, pay for essential services, or book train tickets, FlexPay has got you covered. With a simple and quick loan application process, you can get a loan of up to 3 lakhs online, with flexible monthly installments and competitive interest rates. What sets FlexPay apart is its unique Scan-now Pay-later option, which allows you to make purchases using your smartphone and pay later at your convenience. Say goodbye to the stress of financial emergencies with FlexPay.

Features of FlexPay: Personal Loan App:

* Instant Access to Credit: FlexPay offers a quick and hassle-free way to access credit, providing customers with a loan of up to 3 lakhs online. With this app, you can get the funds you need within minutes, avoiding the lengthy processes of traditional loan applications.

* Simple and Quick Loan Application Process: FlexPay aims to simplify the loan application process. With just a few simple steps, you can complete the application and receive instant approval. The app eliminates the need for extensive paperwork and long wait times, making it convenient and efficient for users.

* Scan-Now Pay-Later Option: FlexPay: Personal Loan App introduces an innovative feature that allows users to scan receipts and pay for their purchases later. This feature offers flexibility and convenience, allowing users to make purchases without worrying about immediate payment.

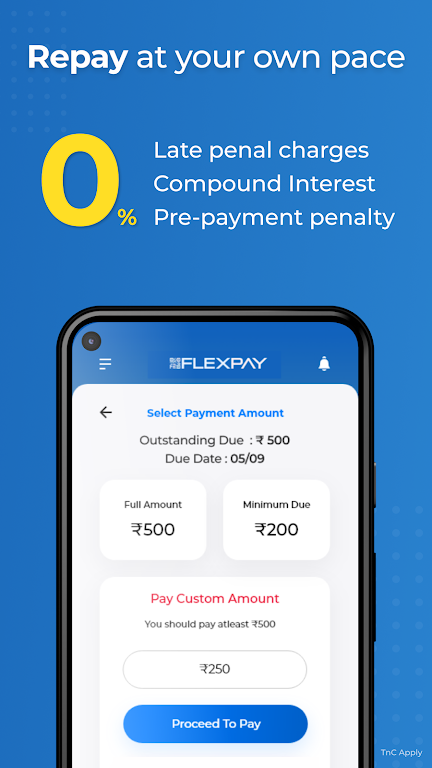

* Flexible Payment Options: FlexPay offers flexible monthly installment options, ensuring that users can choose a repayment plan that suits their financial situation. The minimum payable amount is ₹8,000, giving users the freedom to manage their payments based on their income and expenses.

Tips for Users:

* Explore the Maximum Loan Amount: Take full advantage of FlexPay's loan offering of up to 3 lakhs. Assess your financial needs and borrow an amount that will cover your expenses without burdening your finances.

* Complete the Application Accurately: To ensure a smooth and quick loan approval process, make sure to provide accurate information during the application. Double-check all the details to avoid any delays or rejections.

* Utilize the Scan-Now Pay-Later Option: Make use of the convenient Scan-Now Pay-Later feature when making purchases. Simply scan your receipts and pay at a later time, giving you more flexibility in managing your expenses.

Conclusion:

FlexPay: Personal Loan App is an online personal loan app designed to simplify the lending process for individuals in India. With its instant credit access, simple application process, and innovative features like Scan-Now Pay-Later, FlexPay offers convenience and flexibility to its users. By utilizing this app, you can easily get a quick loan online and use it for various purposes, such as groceries, medicines, or bike services. The flexibility in repayment options further enhances the user experience. Overall, FlexPay strives to be one of the most user-friendly personal loan apps in India, delivering a seamless borrowing experience.

Similar Apps

You May Also Like

Latest Apps

-

Download

Download마이달링

Communication / 42.70MB

-

Download

DownloadAarong

Shopping / 9.10MB

-

Download

DownloadMarliangComic

News & Magazines / 3.40MB

-

Download

DownloadHide Pictures & Videos - FotoX

Tools / 34.49MB

-

Download

DownloadSlovakia Dating

Communication / 12.90MB

-

Download

DownloadAman Car

Travel / 8.18MB

-

Download

DownloadDOTDOT

Personalization / 11.00MB

-

Download

DownloadAuctionTime

Finance / 15.60MB

-

Download

DownloadShareMe

Others / 35.20MB

-

Download

DownloadMstyle

Lifestyle / 30.30MB

Comments