Credit Card Reader

-

4.5

- 330 Votes

- 24.7.12 Version

- 4.80M Size

About

Recommend

Discover

Introduction

Introducing the Credit Card Reader app, a game-changer for businesses of all sizes. With over 199 million verified credit card holders in the US alone, it's clear that credit card use is on the rise. That's why more and more businesses are turning to mobile credit card readers to stay ahead of the game. These affordable devices cost a fraction of traditional stationary machines and offer transaction fees of less than 3 percent. But the benefits don't stop there. With mobile readers, you can easily keep track of every transaction, run reports, and even customize your pricing. Plus, the flexibility to accept payments on the go means no more missed opportunities or disappointed customers. And it's not just about convenience – using a mobile credit card swiper makes your business appear more professional and established. So why limit your business to cash transactions? Embrace the advantages of the app and watch your revenue soar.

Features of Credit Card Reader:

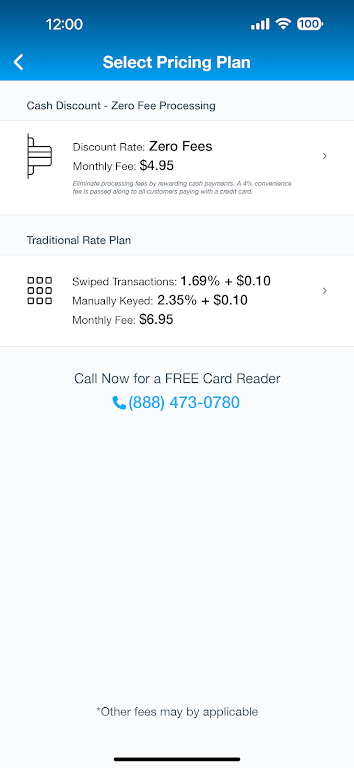

❤ Affordable: Mobile credit card machines are celebrated for their cost-effectiveness, with lower transaction fees than stationary counterparts.

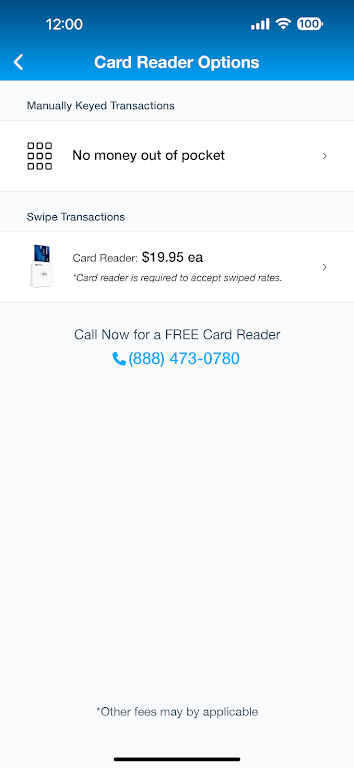

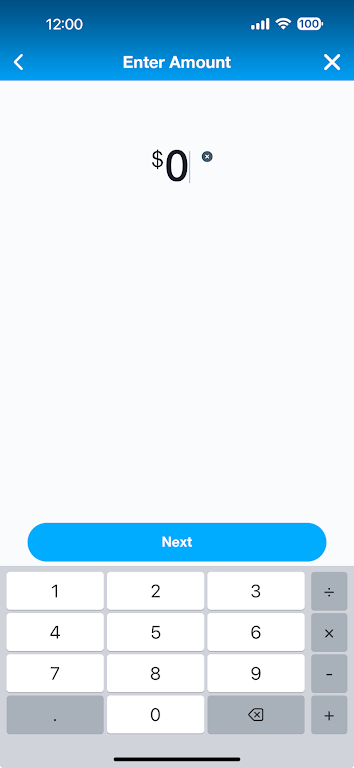

❤ Ease of Use: It is easy to operate and take payments almost immediately after set up.

❤ Numerous Features and Capabilities: The app offer a variety of features, such as the ability to run reports, track transactions, and customize price structures.

❤ Flexibility: Ideal for businesses on the go, mobile credit card terminals enable transactions outside of a brick-and-mortar establishment, expanding the customer base.

FAQs:

❤ How much does the app cost?

It are significantly cheaper than stationary counterparts, and transaction fees are generally less than 3%.

❤ Can the app work with different platforms?

Yes, it is best to choose a reader that works across multiple platforms, such as Android and iPhone.

❤ Can the app track fraudulent charges?

Yes, every transaction and receipt is automatically saved to your mobile POS account, making it easier to track fraudulent charges.

❤ Is it suitable for businesses that frequently travel?

Yes, mobile credit card terminals are ideal for businesses on the go, such as food trucks, makeup artists, and individual proprietors who travel often for work.

Conclusion:

Mobile readers offer a range of features and capabilities, making it easier to track transactions and customize prices. Additionally, using a mobile credit card terminal helps small businesses appear more established and valid in the eyes of customers. With lower transaction fees and the ability to accept credit and debit cards on the go, the advantages of using Credit Card Reader are undeniable.

Similar Apps

You May Also Like

Latest Apps

-

Download

DownloadGoogle Maps Go

Tools / 1.00MB

-

Download

DownloadManga Phoenix

News & Magazines / 3.90MB

-

Download

DownloadBaby songs free Nursery rhymes

Lifestyle / 53.80MB

-

Download

DownloadLivestream TV - M3U Stream Player IPTV

Media & Video / 8.20MB

-

Download

Downloadibis Paint X - New 2019

Personalization / 26.20MB

-

Download

DownloadSeries Film

Media & Video / 1.50MB

-

Download

DownloadIPTV Playlist

Media & Video / 0.60MB

-

Download

DownloadFuture EV

Lifestyle / 15.60MB

-

Download

DownloadFairmatic Insurance

Lifestyle / 27.00MB

-

Download

DownloadCosmoProf Beauty

Lifestyle / 36.03MB

Comments