Akseleran - Pendanaan UKM

-

4.1

- 314 Votes

- 3.22.8 Version

- 20.80M Size

About

Recommend

Discover

Introduction

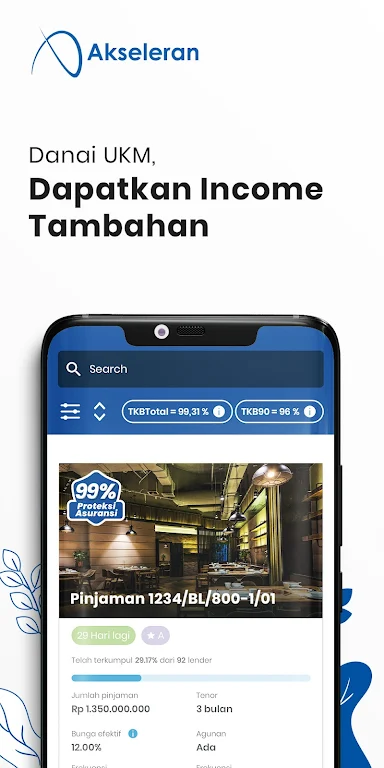

Akseleran - Pendanaan UKM is a fintech crowdfunding platform in Indonesia designed to connect small and medium-sized enterprises (SMEs) with lenders who have funds to invest in their businesses. With Akseleran, lenders can easily access affordable loans starting from IDR 100 thousand without additional fees. The platform is reliable and supervised by the Financial Services Authority, ensuring the safety of investments. Lenders can earn attractive interest rates of 9.5%-10.5% per year, higher than traditional investment instruments. On the other hand, SMEs benefit from competitive interest rates, flexible collateral options, and affordable costs. With Akseleran, you can accelerate your financial and business future. Start today!

Features of Akseleran - Pendanaan UKM:

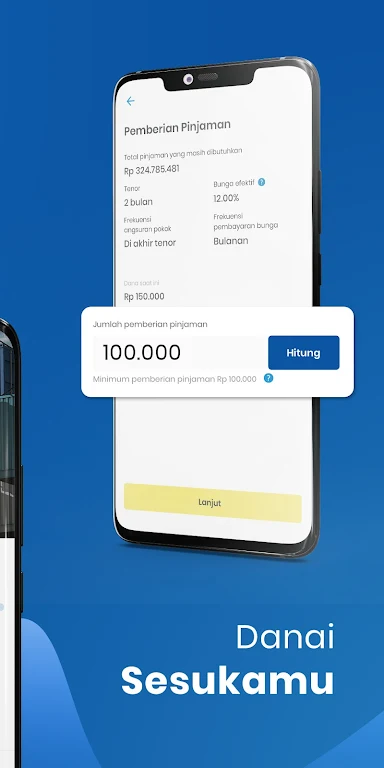

* Accessible and Affordable Funding

Akseleran provides easy access to loans with affordable initial funds starting from IDR 100 thousand without additional fees. This makes it convenient for lenders to develop funds and support the growth of small and medium-sized enterprises (SMEs) in Indonesia.

* Reliable and Regulated Platform

As a registered and supervised fintech platform, Akseleran operates under the supervision of the Financial Services Authority (OJK). With a full operational permit, borrowers and lenders can trust in the platform's professionalism and compliance with industry standards.

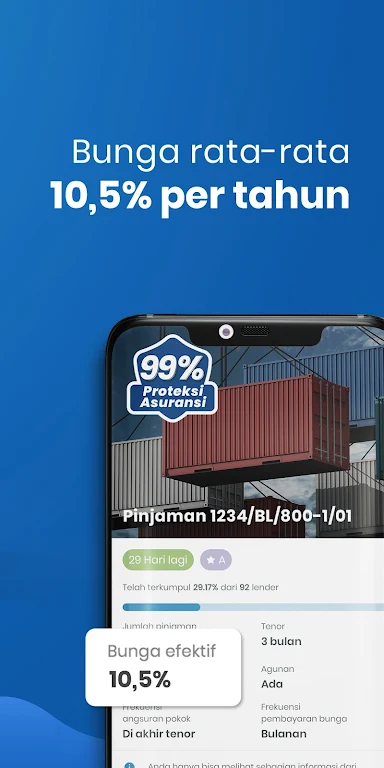

* Competitive Interest Rates

Lenders can earn an average interest of 9.5% - 10.5% per year, which is higher than some conventional investment instruments. This allows lenders to maximize their potential income and achieve their financial goals.

* Flexible Collateral Options

SMEs applying for loans on Akseleran can choose from a range of collateral options, including invoices, inventory, and purchase orders/contracts. This flexibility makes it easier for SMEs to secure funding and expand their business operations.

Tips for Users:

* Start Small and Diversify

For lenders who are new to P2P lending, it is recommended to start with smaller loan amounts to familiarize yourself with the platform and the lending process. Additionally, diversify your investments by lending to multiple SMEs to minimize risk.

* Review borrower profiles

Take the time to thoroughly review the profiles and financial condition of borrowers before making any lending decisions. Consider factors such as the borrower's business history, repayment capability, and risk assessment to make informed investment choices.

* Regularly Monitor and Reinvest

Monitor your lending portfolio regularly to track the performance and repayment status of borrowers. Reinvest your returns to compound your earnings and maximize the potential returns on your investments.

Conclusion:

With its accessible funding options, reliable and regulated platform, competitive interest rates, and flexible collateral options, Akseleran - Pendanaan UKM provides a compelling solution for those looking to support the growth of SMEs or obtain funding for their own businesses. By following the playing tips of starting small and diversifying investments, reviewing borrower profiles, and regularly monitoring and reinvesting, lenders can maximize their earning potential and contribute to the development of the Indonesian SME sector. Start your journey with Akseleran today.

Similar Apps

Latest Apps

-

Download

Download마이달링

Communication / 42.70MB

-

Download

DownloadAarong

Shopping / 9.10MB

-

Download

DownloadMarliangComic

News & Magazines / 3.40MB

-

Download

DownloadHide Pictures & Videos - FotoX

Tools / 34.49MB

-

Download

DownloadSlovakia Dating

Communication / 12.90MB

-

Download

DownloadAman Car

Travel / 8.18MB

-

Download

DownloadDOTDOT

Personalization / 11.00MB

-

Download

DownloadAuctionTime

Finance / 15.60MB

-

Download

DownloadShareMe

Others / 35.20MB

-

Download

DownloadMstyle

Lifestyle / 30.30MB

Comments