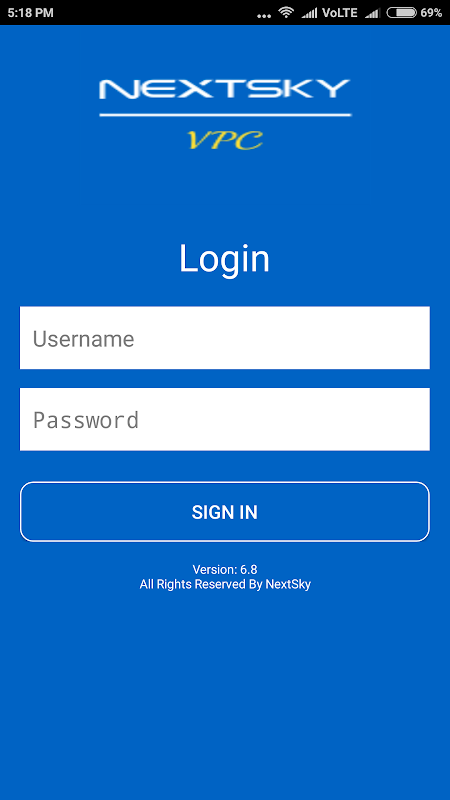

Nextsky VPC

-

4.5

- 197 Votes

- 8.3 Version

- 1.60M Size

About

Recommend

Discover

Introduction

Introducing Nextsky VPC, the ultimate solution for accurate and reliable customer verification. With our Third-Party Verification (TPV) feature, you can have peace of mind knowing that an outside organization has thoroughly reviewed and confirmed your customer's information. No more wasting time on potential customers who lack genuine interest. Under our Customer Profile Validation (CPV) vertical, the app offers a range of verification services, including Address Verification, Tele Verification, and Document Verification, for the banking and non-banking sectors, as well as the insurance industry. Say goodbye to uncertainty and embrace the power of the app.

Features of Nextsky VPC:

I. Enhanced Accuracy and Security:

Nextsky VPC provides third-party verification services, ensuring that customer information is accurate and confirming their intent. This external review guarantees that the data is reliable and trustworthy, offering enhanced accuracy and security for businesses.

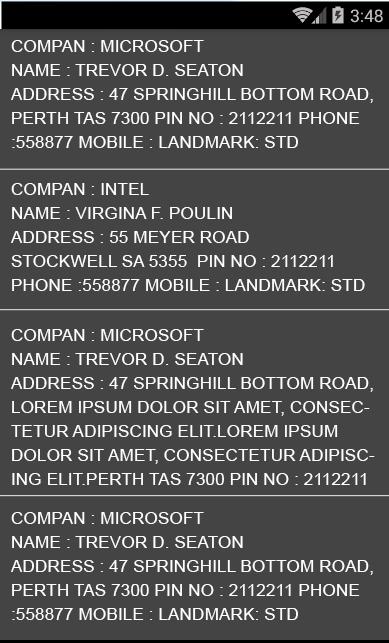

II. Versatile Verification Services:

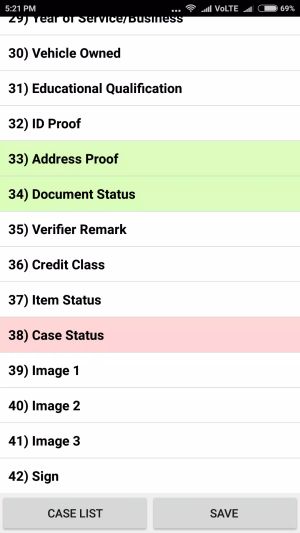

Within the CPV vertical, the app offers a wide range of verification services, including address verification, tele verification, and document verification. These services cater to the specific needs of banking and non-banking sectors, as well as the insurance industry.

III. Comprehensive Coverage:

Nextsky VPC handles a significant volume of credit cards, KYC (Know Your Customer), and retail assets products, such as personal loans, business loans, auto loans, education loans, mortgage loans, commercial vehicle loans, and home loans. This comprehensive coverage enables businesses to validate customer profiles effectively.

IV. Efficient Turnaround Time:

With their efficient turnaround time (TAT), the app minimizes the waiting period between case allocation and case closure. This allows businesses to streamline their operations and provide quick and efficient services to their customers.

FAQs:

What is third-party verification (TPV)?

Third-party verification is the process in which an external organization reviews customer information to ensure its accuracy and confirm the customer's intent. It is commonly used in sales and loan departments to validate customer interest before transferring them to a salesperson.

How can the app benefit the banking sector?

Nextsky VPC offers various verification services, such as address verification and document verification, that are crucial for validating customer profiles in the banking sector. This helps banks ensure the accuracy of customer information and reduces the risk of fraud.

What industries can benefit from the app's services?

Its services are designed to cater to the needs of banking and non-banking sectors, as well as the insurance industry. Their versatile verification services, including tele verification and document verification, provide comprehensive support to businesses in these sectors.

Conclusion:

With a wide range of verification options and comprehensive coverage of various loan and retail asset products, the app assists banks and insurance companies in validating customer profiles effectively. Additionally, their efficient turnaround time ensures quick and reliable services, enabling businesses to streamline their operations. By partnering with AG Professionals Pvt. Ltd., Nextsky VPC continues to deliver top-notch verification solutions to their clients. Click here to download this app and experience the benefits of next-generation verification services.

Similar Apps

You May Also Like

Latest Apps

-

Download

Download마이달링

Communication / 42.70MB

-

Download

DownloadAarong

Shopping / 9.10MB

-

Download

DownloadMarliangComic

News & Magazines / 3.40MB

-

Download

DownloadHide Pictures & Videos - FotoX

Tools / 34.49MB

-

Download

DownloadSlovakia Dating

Communication / 12.90MB

-

Download

DownloadAman Car

Travel / 8.18MB

-

Download

DownloadDOTDOT

Personalization / 11.00MB

-

Download

DownloadAuctionTime

Finance / 15.60MB

-

Download

DownloadShareMe

Others / 35.20MB

-

Download

DownloadMstyle

Lifestyle / 30.30MB

Comments